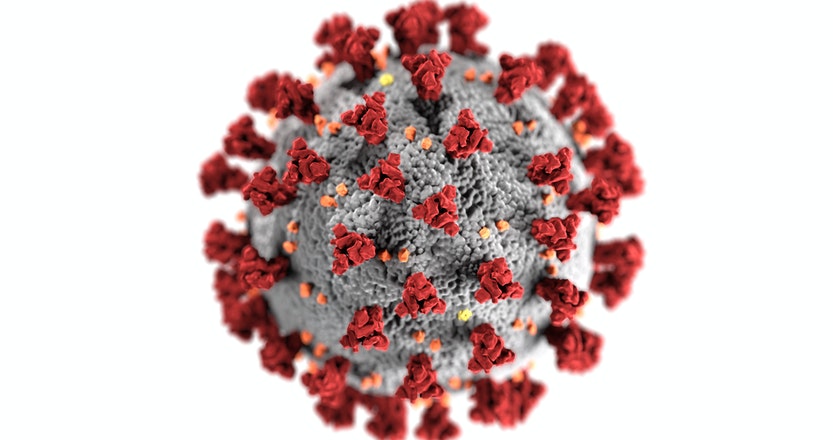

There is no doubt that novel Coronavirus has had an effect on international financial management.

As soon as the World Health Organisation identified the virus as a global pandemic, central banks in some countries started preparing packages to stimulate their economy.

Some reduced their policy rate, others provided liquidity to various financial institutions, while some institutions extended the duration of loans other commercial banks, retail and universal banks owed them.

In addition, some central banks reduced the cost for transfer of money across platforms. It is worth stating that the credit mark was seriously hit amid the Coronavirus pandemic.

This is because debtors of mortgages, domestics loans, corporate loans and traders started defaulting their payments to the banks – which resulted in making them illiquid.

The lockdown in most parts of the world made commerce come to a standstill. People in lockdown could not go out and work or conduct business.

This led to a drop in the rate of deposits at various universal banks. The main reason why central banks cut down their policy rate was to increase lending.

Hence, corporations could access finance at lower rates so they could keep their business alive at time when sales had reduced and other lenders were unwilling to lend.

Multinational corporations such as Rent a Car, ALDO group, Avianca, Chuck E. Cheese, Comcar Industries, Diamond Offshore Drilling, Hertz, Ravn Air, Virgin Australia, Whiting Petroleum, and True Religion for instance have filed for bankruptcy.

The pandemic has exposed financial institutions and payments systems that are not agile to financial technology.

Financial technology has really helped with mitigation of negative effects from the pandemic on international finance management.

Investors who predicted that Coronavirus would be a global pandemic sold their stocks in the affected industries and rather purchased stocks of the health equipment manufacturing firms.

Specifically, laboratories in vaccinations, corporations producing ventilators, thermometer guns, and personal protective equipment such boots, face masks, protective gear and so forth.

This was made possible because of existing fintech applications. The pandemic influenced firms to innovate information technology products to suit their business operations.

The lockdown period led to people increasingly transacting international business through financial technology products.

It has been noted that the coronavirus’s statistics have been inconsistent, and data analysts that fall.